Crypto Fear and Greed Index Explained

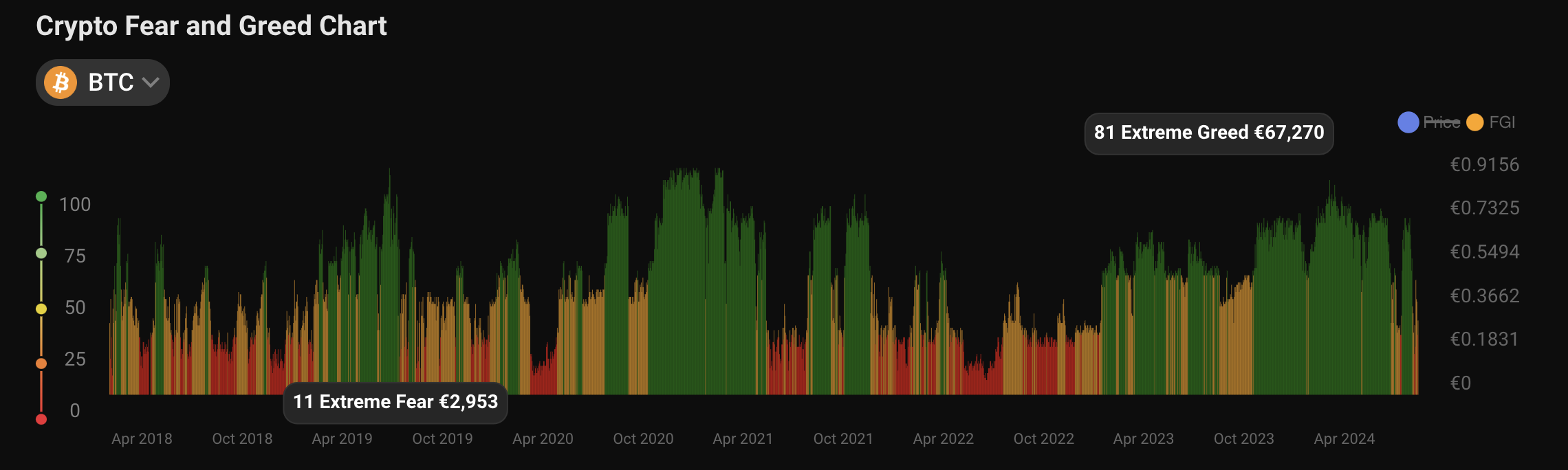

The concept of “Greed and Fear” comes from the stock market and traditional finance. In the crypto world, the index is usually based on Bitcoin data. The Fear and Greed index is a tool that analyzes emotions and sentiments from different sources and crunches them into one simple number, ranging from 0 to 100. A score of zero means “Extreme Fear,” and a score of 100 represents “Extreme Greed”.

How Is Crypto Fear & Greed Index Calculated?

The Fear & Greed index for cryptocurrencies like Bitcoin (BTC) is calculated using various data sources that show the general mood of the crypto market. Here are some of the frequently used types of data:

- Volatility: A sudden spike in volatility often points to a fearful market.

- Market volume: High buying volumes on a consistent basis can suggest that the market is acting greedily.

- Social media and surveys: A high volume of posts and hashtags can indicate growing public interest and greed.

- Bitcoin dominance is the market cap share of Bitcoin compared to the entire crypto market. An increase in Bitcoin’s dominance suggests fear in the market, as investors might be moving away from riskier altcoins.

- Google Trends data: Bitcoin-related search queries.

What Affects the Fear and Greed Index

In January 2024, Bitcoin reached the “extreme greed” level, scoring 76 due to anticipation of the Bitcoin ETF approval.In July 2024, the crypto Fear and Greed index fell to “extreme fear.” This drop was caused by news that Mt. Gox, a Bitcoin exchange that collapsed in 2014, started paying back its creditors. This could potentially release billions worth of Bitcoin onto the market, driving the price down. Additionally, the German government sold a significant amount of its BTC holdings around the same time.

As you can see, the fear and greed in the crypto market are impacted by various events and market conditions that influence investor sentiment and behavior. Here are some key factors that can trigger them:

- Market news and events: News about regulatory changes, hacks or security breaches, technological advancements, or macroeconomic events can significantly affect investor sentiment. For example, announcements about countries banning or regulating cryptocurrencies can instill fear, but news of mainstream adoption can trigger greed.

- Price fluctuations: Sharp price increases can lead to greed as investors rush to capitalize on rising values, while sudden price drops can trigger fear.

- Global economic conditions: Broader economic factors such as interest rates and the health of the global economy can influence risk appetite. Economic instability can make safer assets more appealing, driving fear in riskier markets like crypto.

- Technological developments: The launch of new platforms, enhancements in blockchain technology, or scalability improvements can create a greedy market atmosphere.

- Influential figures and media: Positive endorsements or investments by famous personalities can lead to greed, while criticism can cause fear.

- Market manipulation: Pump-and-dump schemes or whale movements (large holders moving significant amounts of cryptocurrency) can also sway sentiment.

How to Use the Fear and Greed Index

The Fear and Greed index is a useful tool for traders and investors. It helps you gauge market sentiment and make more informed decisions.Warren Buffett, a famous American businessman and investor, advised to be “fearful when others are greedy, and greedy when others are fearful.” This strategy suggests that the best time to buy is when others are panicked, and the best time to sell is when others are overly confident.

When the index shows “extreme fear,” it may indicate that investors are overly cautious, possibly making it a good time to buy. On the other hand, “extreme greed” suggests that the market might soon adjust or drop.

Trading based on the Fear and Greed index can be effective, but always consider it as one part of a broader investment strategy. No investment strategy guarantees success, and it’s crucial to do your own research or consult with a financial advisor.

.jfif)

.jfif)

0 Comments